The only proviso is that it is above 15.

Vat rate for carpet france.

However it excludes stuck down carpet.

The french vat rates are as follows.

Suppliers of goods or services vat registered in france must charge the appropriate vat rate and collect the tax for onward payment to the french tax authorities through a vat filling.

Mapping apps locate nearby atms and banks and restaurants pharmacies etc with google maps apple maps citymaps2go etc.

It applies to most goods and services.

Oanda currency conversion tool with handy app version.

The supply and installation of such carpet is liable at the reduced rate subject to the 2 3rds rule.

Which goods or services.

All other taxable goods and services.

Whilst france follows the eu rules on vat compliance it is still free to set its own standard upper vat rate.

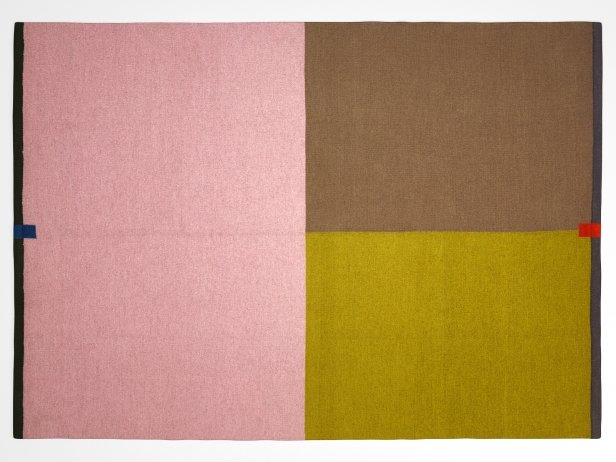

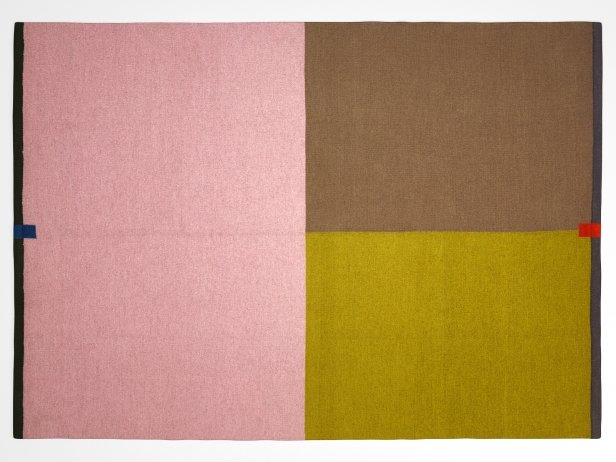

Includes carpet lino tiles etc.

Value added tax consolidation act 2010 vatca 2010 ref.

Federal trade commission advice on bank card theft and more.

Your bank s mobile app.

Nerdwallet objective advice on debit and credit card options for overseas trips.

France vat refund for visitors.

See french vat returns briefing.

This is really odd as i am getting mixed views when doing cis carpet fitters are exempt for laying carpets.

Bankrate compares bank card fees.

A reduction of the vat rate from 19 to 7 potentially 5 from 1 july 2020 31 december 2020 for restaurant and catering services with the exception for drinks.

Someone has also said that carpets are exempt from vat i was wondering if they could be getting mixed up with cis but they are owners of a carpet shop so i am very confused.

France also has some zero rated goods the sale of which must still be reported on your vat return even though no vat is charged.

France has opted for the reduced and super reduced vat rates on a number of items allowed by the vat directive.

The only proviso is that it is above 15.

A reduction of the vat rate for any type of transport coffee and non alcoholic beverages from 24 to 13.

The two reduced vat rates are 10 and 5 5.

The super reduced rate is 2 1.

However if stuck down over their entire surface it is liable to the reduced rate subject to the 2 3rds rule.

The new rate applies from 1 july 2020 to 30 june 2021.

10 5 5 and 2 1.

France s vat rate of 20 ranks as one of the ten highest vat rates in the world countries with similar vat rates include belgium with a vat of 21 ireland with a vat of 21 and finland with a vat of 22.